North America Sodium Silicate Market Growth & Trends

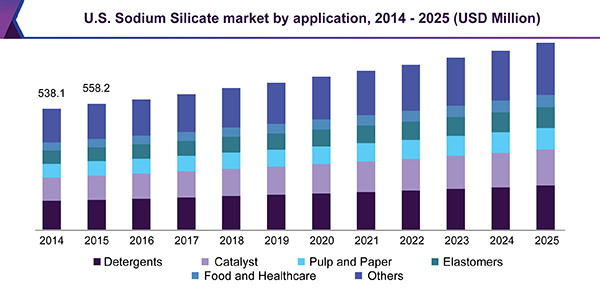

The North America sodium silicate market size is expected to reach USD 1.05 billion by 2025, according to a new report by Grand View Research, Inc. North America sodium silicate industry is expected to grow on account of high product demand in mining, water treatment and agriculture applications.

The industry is expected to be highly competitive owing to the presence of major manufacturers including PQ Corporation, PPG Industries, and OxyChem Corporation which dominate the market. High production capacities, wide geographical reach and distribution network offered by these players give them a competitive edge over their counterparts.

The industry players are likely to increase their investment in R&D to enhance product quality and reduce the cost to gain a higher market share. However, high transportation costs associated with liquid sodium silicate coupled with fluctuating raw material price is expected to impact the industry growth.

The majority of the players in the industry are involved in the captive consumption of the product to produce silica gel, precipitated silica and zeolites in order to tap the rising consumer demand. The scope for the sodium silicate production using an innovative bio-based raw material such as rice husk is expected to open new avenues for the industry players.

Request a free sample copy or view report summary:

North America Sodium Silicate Market Report

North America Sodium Silicate Market Report Highlights

- Detergents was the largest application segment in 2016 and is likely to grow at a CAGR of 4.1% from 2017 to 2025 owing to high demand for sodium silicate for manufacturing industrial and household cleaning products

- Pulp and paper segment accounted for 12.3% of the overall demand in 2016 on account of wide application scope for the product to manufacture binding corrugated board, angle boards, paper napkins and toilet tissues

- FDA and EPA have approved the product as safe food additive and drinking water additive for human consumption thereby driving the demand in the region in food & healthcare applications

- PQ corporation and Oxychem Corporation dominated the industry accounting over 50% of the overall production in the U.S. The presence of manufacturers with high production volume and well established distribution network in the region is expected pose threat to the emerging players

- The product pricing, quality and product grades are expected to be the key parameters influencing buyer’s decision. As a result, the manufacturers are likely to invest more in R&D to gain higher share

Discover more from Top Market Research Reports

Subscribe to get the latest posts sent to your email.

Leave a comment