According to a recent report published by Grand View Research Inc., consumer inclination towards trendy packaging and extensive promotional campaigns on new products launched, are accelerating the smokeless tobacco products market expansion.

According to a report, “Smokeless Tobacco Products Market Size, Share & Trends Analysis Report By Product (Chewing Tobacco, Snuff), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts, 2019–2025”, published by Grand View Research, Inc. The global smokeless tobacco products market size is expected to reach USD 22.2 billion by 2025, registering a CAGR of 7.2%, as per a new report by Grand View Research Inc. The market is driven by the significant developments made in the tobacco sector across North America and Asia Pacific. The growth can be ascribed to the expanding middle class population and the rise in their disposable income. This has driven the demand for premium types in the snuff segment with dry and moist forms.

The prominent product launches within the snuff category including the use of nicotine-less products will increase the demand for specialty and premium types in market. Geographically, North America is set to showcase a staggering growth due to presence of a huge consumer base, demand for premium snuffing products, and with product launches in the region.

The increasing demand for sustainable products among consumers is estimated to surge the growth of the chewing type product segment in the market. Moreover, increasing focus of the leading players on chewing product types due to its wide adoption in Asia Pacific countries will fuel its demand in the market. Companies are taking up strategies such as product launches and expanding their capacity so as to increase the market value of their product types in the market.

A free sample copy or view report summary:

www.grandviewresearch.com/industry-analysis/smokeless-tobacco-products-market/request/rs1

Smokeless Tobacco Products Market Highlights

- In January 2021, the New Zealand Ministry of Health rolled out stringent norms under the Smokefree Environments and Regulated Products Act to scrutinize the use of vaping or smokeless tobacco products. The consultation is aimed to increase awareness regarding the adverse effects of nicotine consumption

- In January 2021, the U.S. FDA finalized two regulations for the premarket review of tobacco products. The FDA has also issued approvals for combustible cigarettes, non-combusted cigarettes, and smokeless tobacco through the premarket tobacco product applications (PMTAs) pathway

- In January 2021, the California State government issued a ban on flavored tobacco consumption. A group called the California Coalition for Fairness, largely funded by tobacco giants including Philip Morris USA, R.J. Reynolds Tobacco Co., and it’s affiliated U.S. Smokeless Tobacco Co. signed up in the support of the ban. A 2018 study cited by the U.S CDC reported that 49% of middle school students and 67% of high school students were consuming flavored tobacco products, which alarmed the need for this ban imposition

- Based on product type, chewing tobacco is anticipated to ascend at a CAGR of 8.1% from 2019 to 2025. The snuff segment accounted for the largest market share of 56.3% in 2018

- Asia Pacific is a prominent market space for the sales of chewing and smoking products among the younger age groups. For instance, in 2017, approximately 20% of women in India were addicted to different product types, and about 19.3% in Pakistan

Smokeless Tobacco Products Market Segmentation

Grand View Research has segmented the global smokeless tobacco products market on the basis of product, distribution channel, and region:

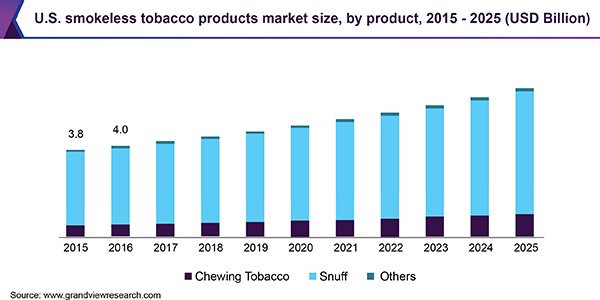

Smokeless Tobacco Products Product Outlook (Revenue, USD Billion, 2015–2025)

● Chewing Tobacco

● Snuff

● Others

Smokeless Tobacco Products Distribution Channel Outlook (Revenue, USD Billion, 2015–2025)

● Online

● Offline

Smokeless Tobacco Products Regional Outlook (Revenue, USD Billion, 2015–2025)

● North America

o U.S.

o Canada

● Europe

o Sweden

o Norway

● Asia Pacific

o India

● Central & South America

● Middle East & Africa

o Algeria

o South Africa

List of Key Players in Smokeless Tobacco Products Market

- Altria Group

- British American Tobacco

- Imperial Tobacco Group

- Gallaher Group Plc

- Universal Corporation

- Reynolds Tobacco Company

Discover more from Top Market Research Reports

Subscribe to get the latest posts sent to your email.

Leave a comment