According to a recent report published by Grand View Research Inc., businesses are navigating the new ways of secured working and a more sheltered set-up amid the COVID-19 outbreak, is accelerating the cyber insurance market expansion.

According to a report, “Cyber Insurance Market Size, Share & Trends Analysis Report By Organization (SMB, Large Enterprise), By Application (BFS, Healthcare, IT & Telecom), And Segment Forecasts, 2019–2025”, published by Grand View Research, Inc. The global cyber insurance market size is expected to reach USD 19.2 billion by 2025, registering a CAGR of 25.6%, as per a new report by Grand View Research Inc. Cyber insurance minimizes business losses incurred due to cybercrimes such as malware, ransomware, distributed denial-of-service attacks, etc., which severely compromises the affected network.

Cyber insurance covers the liability of a business for comprising sensitive customer information including credit card details, breach of data, social security numbers, account details, drivers’ license numbers, and health records. The penetration of advanced technologies such as artificial intelligence (AI), augmented reality (AR), robotics, the Internet of Things (IoT), virtual reality (VR), etc. has supported the market adoption at workplaces and homes.

Demand for cyber insurance originated from telecom firms, banking, IT, and media, which are widely exposed to potential cyberattacks. The types of cyberattacks against businesses are continually evolving and cyber insurance acts as a convenient solution for organizations to receive compensation for financial losses incurred. Growing awareness regarding cybercrimes has facilitated businesses to address, and deploy their risk strategies. Cyber risk insurance is a promising way to mitigate the damage caused by malicious activities.

A sample copy or view summary of this report, click the link below:

www.grandviewresearch.com/industry-analysis/cyber-insurance-market/request/rs1

Cyber Insurance Market Report Highlights

1. As Covid-19 continues to spread, organizations face a greater cyber challenge in understanding data theft or operating in crisis mode due to the implementation and deployment of bring-your-own device (BYOD) versus company-owned devices. This has mandated the adoption of multi-factor authorization, a virtual private network (VPN), and device monitoring systems, thereby strengthening the privacy policies

2. According to the United Kingdom’s National Cyber Security Centre (NCSC) and the United States Department of Homeland Security (DHS) Cybersecurity and Infrastructure Security Agency (CISA), cybercriminals are gaining remote access to teleworking infrastructure. Heightened state of cybersecurity amid the Covid-19 pandemic has impelled businesses to proactively reach out to insurance coverage for security incidents, privacy breaches, and technology outages

3. To prevent the Covid-19 themed cyberattacks, companies like TCS has launched the TCS’ suite of cyber insurance services and solutions to minimize risk exposure, improve consumer experience, and drive business growth

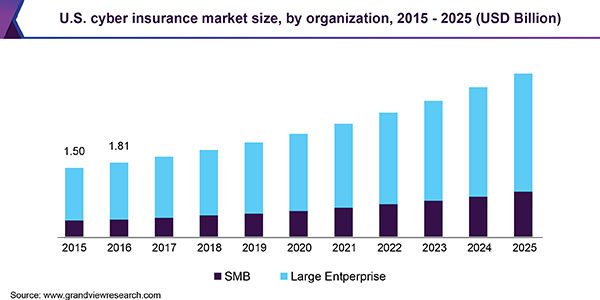

4. The large enterprise segment accounted for the highest share of over 85.0% in 2018, on account of their increasing higher spending capacity for the installation of robust cybersecurity solutions

5. The BFSI application segment dominated the market, accounting for a revenue share of more than 24.0% in 2018. This is attributed to the increasing monetary operations and associated threats related to large-scale frauds, breaches, and heists

6. Asia Pacific is expected to grow at the fastest rate owing to rapid industrialization in emerging economies such as India, China, and other South Asian countries. This regional market has observed an increase in the number of small and medium businesses and will create a significant demand for cyber insurance businesses during the forecast period

Cyber Insurance Market Segmentation

Grand View Research has segmented the global cyber insurance market on the basis of organization, application, and region:

Cyber Insurance Organization Outlook (Revenue, USD Billion, 2015–2025)

o SMB

o Large Enterprise

Cyber Insurance Application Outlook (Revenue, USD Billion, 2015–2025)

o BFS

o Healthcare

o IT & Telecom

o Retail

o Others

Cyber Insurance Regional Outlook (Revenue, USD Billion, 2015–2025)

o North America

o U.S.

o Canada

o Europe

o U.K.

o Germany

o Asia Pacific

o China

o India

o Japan

o Latin America

o Brazil

o Middle East & Africa

List of Key Players of Cyber Insurance Market

1. AON Plc

2. American International Group, Inc.

3. Allianz Group

4. Berkshire Hathaway

5. Lockton Companies, Inc.

6. The Chubb Corporation

7. Munich Re Group

8. XL Group Ltd.

9. Zurich Insurance Co. Ltd.

Discover more from Top Market Research Reports

Subscribe to get the latest posts sent to your email.

Leave a comment