The demand for diabetes care devices in the economies of Brazil, Russia, India, and China is projected to show appreciable growth in the coming years, aided by the significant population base in the region, coupled with increasing incidences of diabetes.

The BRIC diabetes care devices market size is projected to reach USD 4.82 million by the year 2026, advancing at a CAGR of 5.28% over the forecast period, according to a study by Grand View Research, Inc. The market in BRIC nations (Brazil, Russia, India, China) is primarily driven by the increasing prevalence of diabetes, especially among the geriatric and obese population. Glucose impairment has seen an exponential spread among the regional population, on account of increasing alcohol and tobacco consumption, lack of physical activity, and obesity. Diabetes care devices have witnessed a substantial growth in demand across the world, as healthcare institutions and professionals encourage diabetic patients to adopt these products. Governments and private bodies have continued to spread the importance of timely diabetes care through various drives and campaigns, thus making the population more aware, especially in emerging economies such as Brazil, China, and India.

According to the World Health Organization (WHO), more than 50% of the Indian population with diabetes remains undiagnosed. As such, the government has launched a number of initiatives for faster spread of awareness and information. For instance, in 2019, the Research Trust of Diabetes India launched its 1000 days Initiative to control diabetes in the country. This initiative will bring together diabetologists across the country to offer recommendations and clinical guidelines. Additionally, technological advancements coupled with collaborations among key market players is also propelling the market growth, with a continuous stream of innovative products being launched in this space.

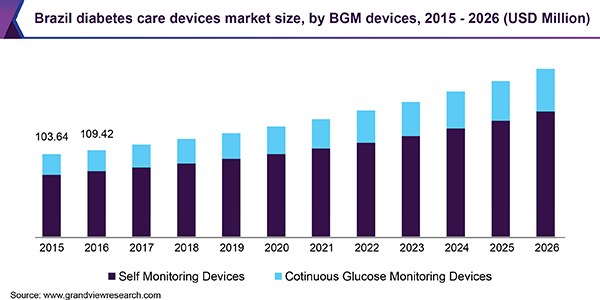

The BRIC diabetes care devices market has been segmented broadly on the basis of product across the countries of Brazil, India, China, and Russia. The products consist of blood glucose monitoring devices and insulin delivery devices. Some of the notable insulin delivery devices include pens, pumps, syringes, and jet injectors. Blood glucose monitoring devices can either be self-monitored or continuous. The self-monitoring segment includes blood glucose meters, testing strips, and lancets. Continuous monitoring segment comprises sensor, transmitter, and receiver. Numerous major industry players have expanded their facilities to the BRICS countries, as they consider these economies as critical to their expansion and growth.

Request a free sample copy or view report summary:

www.grandviewresearch.com/industry-analysis/bric-diabetes-care-devices-market/request/rs1

Some of the prominent industry players include Johnson & Johnson; Ypsomed AG; Bayer AG; F. Hoffmann-La Roche Ltd; Abbott Laboratories; Becton, Dickinson and Company; Medtronic Plc; Sanofi; Novo Nordisk A/S; Acon Laboratories, Inc.; Terumo Corporation; and Dexcom, Inc.

BRIC Diabetes Care Devices Market Report Highlights

1 The BRIC nations are home to a very substantial population base, with the International Journal of Health Policy and Management (2018) stating that these countries accounted for 40% of the global population. As such, there is a very significant diabetic population residing in these economies

2 As per data provided by the United Nations, the number of BRIC population older than 65 years is expected to reach 412 million by 2030, which would result in higher investments in quality healthcare provision, including diabetes care

3 Brazil’s healthcare spending per GDP is projected to increase from 8.3% in 2014 to 10.0% in 2030, signifying the nation’s attempts to curb health issues among the general population

4 According to Dr. Cesar Chelala, an esteemed international public health consultant, Russia sees an annual spending of USD 12.5 billion with regards to diabetic patient care; furthermore, 30% of the population in the economy above the age of 15 years is expected to suffer from obesity, which would result in a spike in the incidences of diabetes in the region

5 Based on product, the insulin delivery devices dominated with over 60% market share in 2018. Among these devices, the insulin pump segment is expected to register the fastest CAGR of 3.81% through 2026 owing to increasing number of patients with glucose impairments and availability of convenient pumps

6 With regards to CGM devices, sensors dominated the segment with a revenue of over USD 100 million in 2018, which can be attributed to high usage and adoption of these devices

7 China held the dominant market position in 2018 and is expected to retain its lead throughout the forecast period. Large diabetes population and supportive government initiatives are the key factors driving market growth in the country

8 The COVID-19 pandemic had a massive impact on the BRIC economies, particularly India and Brazil, which were two of the worst-affected countries globally. With diabetic patients being at a high risk of contracting the disease, remote care has been encouraged in order to restrict the spread of coronavirus

9 Companies are collaborating with regional Government agencies in order to launch innovative products. For instance, in November 2020, Novo Nordisk announced the China Essentials 2.0 program, under which the company had already debuted a new weekly GLP-1 injection semaglutide called Ozempic at the CIIE 2020

BRIC Diabetes Care Devices Market Segmentation

Grand View Research has segmented BRIC diabetes care devices market on the basis of product, and region:

BRIC Diabetes Care Devices Product Outlook (Revenue, USD Million, 2015–2026)

· Blood Glucose Monitoring Devices

o Self-monitoring Devices

§ Blood Glucose Meter

§ Testing Strips

§ Lancets

o Continuous Glucose Monitoring Devices

§ Sensors

§ Transmitter

§ Receiver

· Insulin Delivery Devices

o Pens

o Pumps

o Syringes

o Jet Injectors

BRIC Diabetes Care Devices Regional Outlook (Revenue, USD Million, 2015–2026)

· BRIC

o Brazil

o Russia

o India

o China

Discover more from Top Market Research Reports

Subscribe to get the latest posts sent to your email.

Leave a comment